August 30, 2013

To support construction projects during the busy summer months, the State of Illinois issued $2.0 billion of capital purpose debt, which for the most part will be repaid from the State’s Capital Projects Fund.

The Fund was created to receive the revenues from a package of new taxes and fees that was passed in FY2010 to fund the $31-billion Illinois Jobs Now! capital program. As previously discussed here, these revenue sources have lagged far behind the original legislative estimates. With the additional cost of bonds sold from May through July, the Capital Projects Fund appears to be close to its capacity to fund additional debt.

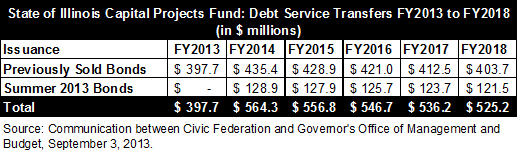

In FY2013 the revenues received in the Capital Projects Fund totaled $627.3 million and the Fund was only responsible for $397.7 million in debt service. The debt service paid from the Capital Projects Fund will jump to $564.3 million in FY2014. The increase is due to $1.3 billion in General Obligation Bonds sold on July 2 and $300 million of Build Illinois Bonds sold on May 23. The State completed a Build Illinois Bond refunding deal on June 14 totaling $604.1 million, which contributed a slight increase in the Capital Projects Fund debt service transfer. The increase was due to advanced repayment of principal but was offset by much more significant savings elsewhere in the budget that will reduce the total debt service paid from the State’s share of the sales taxes received by the State of Illinois.

Including the most recent new capital bonds sold, the State has issued approximately half of the debt needed to pay for the $16 billion in debt-funded capital projects originally approved by the General Assembly in FY2010.

The following chart shows the debt service due from the Capital Projects Fund from FY2013 through FY2018.

Although there is some capacity for additional debt supported by the Capital Projects Fund, the available resources are far short of the amount that would be needed to pay for the remaining approved but unfunded projects. According to a report on the FY2014 capital budget from the Commission on Government Forecasting and Accountability (COGFA), prior to the summer bond sales the State had sold $7.1 billion of the currently authorized $13.5 billion in capital-purpose debt. In all, the Illinois Jobs Now! program includes $16 billion in projects to be funded through bond proceeds and repaid from the Capital Projects Fund. After the $2.0 billion in summer bonds are allocated to projects, there will still be roughly $7.0 billion in approved projects waiting on additional bond sales for funding.

As shown here, delays in the full implementation of the legalization and taxing of video gaming is the largest contributor to reduced capital funding. The COGFA report on the capital budget also shows that even after video gaming is fully operational in the State, the Capital Projects Fund may only receive between $47.6 million and $138.2 million in additional resources.

The State also pays capital debt service for funding annual transportation improvements on roads, bridges and mass transit from the Road Fund and State Constructions Fund. The School Infrastructure Fund contributes to debt service for annual school maintenance and improvements. If the Capital Projects Fund does not have sufficient funds to cover the debt service owed on the new projects included in Illinois Jobs Now!, the remainder is covered by the Road Fund, which must then be repaid out of future Capital Projects Fund revenues.

The State’s General Funds revenues are used to pay for capital bonds approved prior to the authorization of Illinois Jobs Now! and pension bonds sold by the State in FY2003, FY2010 and FY2011. Typically the Build Illinois Bonds are paid from a portion of the State’s sales tax receipts. However, any Build Illinois Bonds sold based on the increased authorization included in Illinois Jobs Now! are paid for out of the Capital Projects Fund.

An earlier version of this blog included marginally different totals for the debt service associated with the Summer 2013 Bond sales. The data was updated per new information provided by the Governor’s Office of Management and Budget. Debt service associated with the June 14 Build Illinois Bond refunding was originally shown as part of the total Summer 2013 Bonds debt service. For clarity, this blog was edited to reflect only the increased debt service associated with the refunding bonds in the Summer 2013 category and the original cost in the Previously Sold Bonds. The increases associated with the refunding to be paid from the Capital Projects Fund totaled $154,169 in FY2014; $182,616 in FY2015, FY2016 and FY2017; and $347,437 in FY2018. The change in category did not affect the total debt service calculation.